In today’s fast-paced world, it is more important than ever to have a savings account to secure your financial future. Whether you are saving for a rainy day, a big purchase, or retirement, finding the right bank for your savings account in the Philippines is crucial.

With so many options available, it can be overwhelming to decide which bank is the best fit for your needs. That’s why we have done the research for you and compiled a list of the top banks in the Philippines for saving accounts.

Choosing the Best Bank for Your Savings Account in the Philippines

When it comes to finding the best bank for your savings account in the Philippines, there are several factors to consider. It’s important to choose a bank that offers competitive interest rates, convenient banking services, and reliable customer service.

There are several factors to consider to help you make an informed decision. These factors include:

| Interest Rates: | Compare the interest rates offered by different banks. Higher interest rates can help your savings grow faster over time. |

| Fees and Charges: | Be aware of any fees and charges associated with maintaining a savings account. These may include transaction fees, ATM withdrawal fees, and minimum balance requirements. |

| Accessibility: | Consider the convenience and accessibility of the bank’s branches and ATMs. Choose a bank with a wide network that is easily accessible to you. |

| Customer Service: | Research the reputation of the bank’s customer service. Look for a bank that provides excellent customer support and assistance whenever you need it. |

| Account Features: | Review the features of the savings account, such as online banking, mobile app access, and additional perks, to determine if they align with your needs and preferences. |

| Security: | Ensure that the bank you choose has robust security measures in place to protect your savings from fraud and unauthorized access. |

By considering these factors, you can select the best bank for your savings account in the Philippines that suits your financial goals and needs.

Interest Rates

When choosing a savings account, one of the most important factors to consider is the interest rate. The interest rate determines how much your savings will grow over time.

Most banks offer tiered interest rates, which means that higher account balances earn higher interest rates. This encourages customers to save more money and earn more interest.

It’s important to compare the interest rates offered by different banks to find the best deal for your savings. Some banks offer higher interest rates for specific types of savings accounts, such as time deposit accounts or high-yield savings accounts.

Additionally, some banks may offer promotional interest rates for new customers or for a certain period of time. These rates may be higher than normal, but it’s important to check if there are any requirements or limitations to qualify for them.

Remember that interest rates can change over time, so it’s important to regularly review the rates and compare them with other options. By choosing a savings account with a competitive interest rate, you can maximize your savings and reach your financial goals faster.

Minimum Balance Requirements

When choosing a savings account in the Philippines, it is important to consider the minimum balance requirements imposed by each bank. These requirements refer to the minimum amount of money that must be maintained in the account at all times. If the balance falls below this limit, the bank may charge fees or impose penalties.

Each bank has its own minimum balance requirements, so it is essential to review and compare them before opening an account. Some banks require a higher minimum balance, while others have lower requirements.

Typically, larger banks have higher minimum balance requirements, while smaller, local banks have lower requirements. It is important to assess your financial situation and determine how much you can comfortably maintain in your savings account on a regular basis.

The minimum balance requirements may also vary depending on the type of savings account you choose. For example, some banks may have lower requirements for a basic savings account compared to a high-yield savings account.

In addition to the minimum balance requirements, it is also important to consider whether the bank charges any fees for falling below the required amount. Some banks may waive the fees for the first few months or only charge them if the balance falls below the requirement for an extended period.

Account Access and Convenience

When choosing a bank for your savings account in the Philippines, it’s important to consider the account access and convenience provided by the bank. Here are some factors to consider:

| Bank | Online Banking | Mobile Banking | Branches and ATMs |

| Bank A | Yes | Yes | 100+ |

| Bank B | Yes | Yes | 50+ |

| Bank C | No | Yes | 200+ |

| Bank D | Yes | No | 150+ |

Online banking is a convenient way to access your savings account from the comfort of your own home. It allows you to check your account balance, transfer funds, pay bills, and manage your account online.

Mobile banking takes convenience a step further by allowing you to access your savings account using your smartphone or tablet. With mobile banking apps, you can perform most banking transactions on the go, making it easy to manage your savings account wherever you are.

Having a bank with a wide network of branches and ATMs is also important. This ensures that you can easily deposit or withdraw money from your savings account whenever you need to, no matter where you are located.

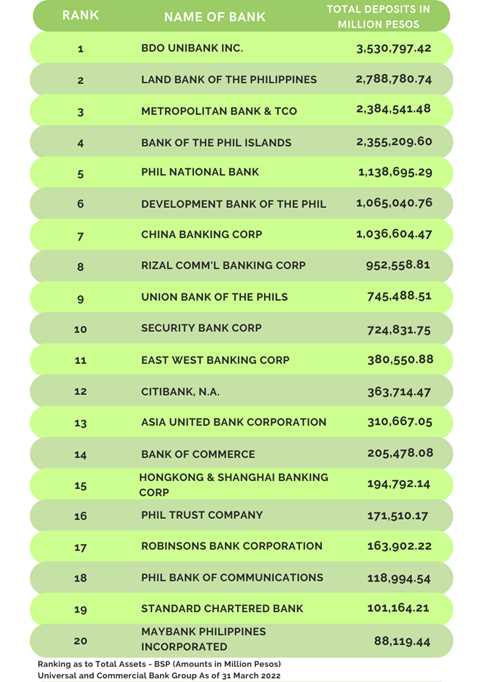

Top Banks for Savings Accounts in the Philippines

When it comes to choosing a bank for your savings account in the Philippines, there are plenty of options to consider. Here are some of the top banks that offer competitive interest rates and reliable services.

Asia United Bank (AUB)

AUB offers savings accounts with competitive interest rates and flexible options for accessing your funds. They also provide convenient features such as online and mobile banking, making it easy to manage your savings.

Before making a decision, it’s important to compare the different offerings of these banks and consider factors such as interest rates, fees, and account features. Additionally, you may want to check if the bank has a strong reputation for customer service and security.

With the right savings account from a trusted bank, you can be on your way to reaching your financial goals in the Philippines.

Bank of the Philippines Islands (BPI)

Bank of the Philippines Islands (BPI) is one of the oldest and most prestigious banks in the Philippines. With a strong reputation and a long history, BPI has become one of the top choices for Filipinos looking for a savings account.

One of the key advantages of opening a savings account with BPI is the convenience and accessibility it offers. BPI has a wide network of branches and ATMs across the country, making it easy for customers to access their accounts and perform transactions.

BPI also offers a range of savings account options to cater to different needs and preferences. Their savings accounts come with competitive interest rates, allowing customers to earn passive income on their savings. Whether you’re looking for a basic savings account or one with additional features like online banking and debit cards, BPI has an option that suits your requirements.

Customer service is another area where BPI excels. The bank has a dedicated customer support team that is available 24/7 to assist customers with their concerns and inquiries. This level of customer support ensures that you’ll have a smooth and hassle-free experience with your savings account.

Security is a top priority for BPI. They employ rigorous security measures to protect customer information and funds. BPI incorporates state-of-the-art technology to ensure that your savings account remains safe and secure at all times.

Metropolitan Bank and Trust Company (Metrobank)

Metropolitan Bank and Trust Company, commonly known as Metrobank, is one of the largest and most trusted banks in the Philippines. Metrobank offers several types of savings accounts, each designed to meet different savings goals. One of their popular savings account options is the “Regular Savings Account”. This account allows customers to conveniently save money and earn interest while maintaining easy access to their funds through the bank’s extensive network of branches and ATMs.

For customers who want to earn higher interest rates on their savings, Metrobank also offers the “Metrobank Fun Savers Club” account. This account is specially designed for children and teenagers, allowing them to learn the basics of saving money while earning attractive interest rates.

Metrobank also provides the option of opening a savings account with a passbook. This is a great choice for customers who prefer to have a physical record of their transactions and balances. The passbook also offers added security, as customers need to present it when making transactions at the bank.

One of the key features of Metrobank’s savings accounts is their online banking platform. With Metrobank Online, customers can conveniently manage their accounts, transfer funds, pay bills, and even open new accounts online. This makes it easy for customers to track their savings and make transactions at their own convenience.

In addition to their savings account options, Metrobank also provides other services such as time deposits, credit cards, loans, and investment products. These additional offerings make Metrobank a one-stop financial institution that can cater to a variety of banking needs.

| Savings Account | Minimum Initial Deposit | Interest Rate |

| Regular Savings Account | PHP 2,000 | 0.25% p.a. |

| Metrobank Fun Savers Club | PHP 100 | 0.125% p.a. |

| Passbook Savings Account | PHP 10,000 | 0.25% p.a. |

BDO Unibank

BDO Unibank, Inc. (BDO) is one of the largest and most trusted banks in the Philippines. It offers various savings account options tailored to meet the diverse needs of its customers.

Features:

1. BDO Passbook Savings Account: This account provides a passbook for easy tracking of transactions. It offers a competitive interest rate and requires an initial deposit and maintaining balance.

2. BDO Optimum Savings Account: This account offers a higher interest rate compared to regular savings accounts. It requires a higher maintaining balance but provides additional benefits like insurance coverage, free membership rewards, and priority banking services.

Benefits:

1. Accessibility: BDO Unibank has an extensive network of branches and ATMs nationwide, making it convenient for customers to deposit, withdraw, and access their savings.

2. Online Banking: BDO’s online banking platform allows customers to manage their accounts, transfer funds, pay bills, and monitor their transactions anytime, anywhere.

3. Security: BDO ensures the security of its customers’ savings through advanced security measures and fraud detection systems.

4. Additional Services: BDO provides additional services such as debit cards, mobile banking, and financial advisory services to enhance the banking experience of its customers.

Best Online Banks for Savings Accounts in the Philippines

If you prefer the convenience of managing your savings accounts online, there are several online banks in the Philippines that offer competitive interest rates and user-friendly platforms. Here are some of the best online banks to consider:

1. ING Bank

ING Bank is known for its high interest rates and easy-to-use online platform. They offer a savings account with no minimum balance requirement and no monthly fees. Plus, they have a 24/7 customer service hotline for any inquiries or concerns.

2. CIMB Bank

CIMB Bank is another popular choice for online savings accounts. With CIMB Bank, you can enjoy a competitive interest rate and no annual fees. They also offer a mobile app that allows you to manage your savings accounts on the go.

3. UnionBank

UnionBank offers an online savings account called UnionBank Online. It has a low initial deposit requirement and competitive interest rates. UnionBank also provides a wide range of digital banking services, including bill payments and fund transfers.

4. Security Bank

Security Bank offers an online savings account called eSecure Savings. It features a high interest rate and a convenient online platform. With eSecure Savings, you can easily monitor and grow your savings anytime, anywhere.

5. BPI Direct

BPI Direct is the online banking arm of the Bank of the Philippine Islands (BPI). They offer a savings account called Save-Up, which allows you to earn higher interest rates while maintaining the flexibility to withdraw your money anytime. BPI Direct also provides a mobile app for convenient account management.

These online banks provide a convenient and secure way to manage your savings accounts. Whether you want to start saving for a specific goal or simply want to grow your wealth, consider opening an account with one of these online banks for a hassle-free experience.

In conclusion

Choosing the best bank for your savings account in the Philippines involves considering factors such as interest rates, convenience, customer service, and the bank’s reputation. You want to find a bank that not only offers competitive interest rates but also has low fees and convenient branch and ATM locations. By doing your research and comparing different options, you can find the right bank that will help you grow your savings and meet your financial goals.

Which bank offers the highest interest rate for savings accounts in the Philippines?

As of now, UnionBank offers the highest interest rate for savings accounts in the Philippines with their UnionBank Regular Savings Account, offering an interest rate of 0.75% per annum. This makes it a great option for maximizing your savings and earning passive income.

What are the requirements to open a savings account in the Philippines?

The requirements to open a savings account in the Philippines may vary depending on the bank, but generally, you will need to provide a valid identification card, proof of address, and an initial deposit amount. Some banks may also require additional documents or have specific criteria for opening an account.

Which bank has the most convenient online banking services for savings accounts?

BDO (Banco de Oro) is known for having one of the most convenient online banking services for savings accounts in the Philippines. Their online platform allows you to easily manage your savings account, transfer funds, pay bills, and perform other banking transactions from the comfort of your own home.

Can I open multiple savings accounts with different banks in the Philippines?

Yes, you can open multiple savings accounts with different banks in the Philippines. In fact, it can be a smart strategy to diversify your savings and take advantage of the different benefits and features offered by different banks. Just make sure to consider the minimum maintaining balance and any associated fees when choosing the banks for your multiple accounts.

Leave a Reply